Unpacking BSP's Flash Insights on Gold in the Market

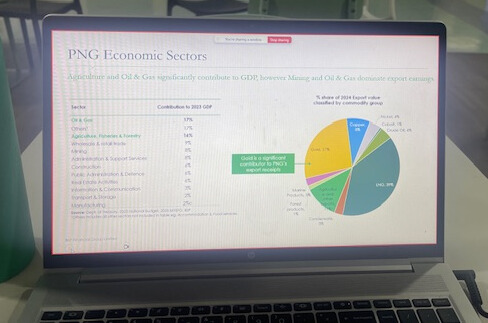

The session provided valuable insights into recent developments in gold prices, foreign exchange (FX) trends, and the broader economic landscape of Papua New Guinea. As the country navigates a complex global market environment, the webinar aimed to equip businesses, investors, and policymakers with current data and strategic perspectives on how commodity prices, currency stability, and upcoming LNG projects could influence PNG’s financial future. Participants gained an understanding of the opportunities and risks present in the evolving gold and forex markets, as well as the government and central bank’s approaches to maintaining economic stability amid external pressures.

Key highlights include:

- Gold prices have recently declined by approximately 6%, creating potential buying opportunities. Meanwhile, gold ETFs continue to gain popularity among investors seeking diversification.

- The importance of gold in PNG’s exports is increasing, buoyed by strong commodity prices in sectors such as oil, gas, and agriculture, which support national revenue streams.

- The Kina is expected to depreciate by about 4.5-5% annually. Discussions are underway about transitioning from a USD peg to a currency basket to improve exchange rate stability.

- Central bank interventions in foreign exchange markets have significantly decreased, signaling a stabilization of the FX market amid high revenues from commodity exports.

- Upcoming LNG project developments are poised to influence FX demand, potentially impacting gold markets and shaping future FX policy decisions.

Despite PNG’s recent greylisting by international financial authorities, local banks and businesses remain well-prepared, and foreign investment continues to flow steadily into the country.

The webinar provided valuable insights into PNG’s economic outlook and investment environment amid global and regional market fluctuations.